http://www.cbsnews.com/stories/2005/11/17/business/main1055453.shtml

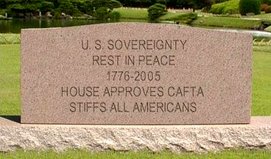

In the above link, one can read about the CEO at General Motors making a statement that there will be no bankruptcy. But, it is an everyday occurrence on CNBC for the journalist to bring in one expert after another that hints that GM needs to file bankruptcy. As a disclosure, I will make note of the fact that I am a General Motors stockholder. My family believes in General Motors, and we believe in driving their automobiles. General Motors is a very big part of our economy, and it is often said that "so goes General Motors so goes the economy."

Now, I have given this topic careful study and the reason in my modest belief system that some on Wall Street destroy General Motors is because their financing arm called GMAC is a perceived threat to those that control the money supply. General Motors Corporation has a book value of about $44 per share, but its common stock is trading at an all time low of about $24 per share. On a daily basis, we see one analyst after another putting sell orders on GM and suppressing the stock value. Even though Toyota had a massive recall of trucks and other SUVs a few months back, it was virtually suppressed in the media. But, we continually hear the doom and gloom recall news about Ford and GM, as if these two important players of the big three automakers in the United States do not know a thing about manufacturing automobiles. But getting back to the book value of General Motors and its depressed stock price, I will direct your attention to the ride that shareholders took with Krispy Kreme (no pun intended), and how when the stock went public the market makers pushed this yeast ridden product to extraordinary highs for its stock value. Now there was virtually no book value, and as one can see there was no hard assets that the corporation held. Afterall, how could perishable food products that do not have a shelf life beyond a day have much of any financial value? My husband said that perhaps we should buy some Krispy Kreme stock when it went public, but I joked that it would not go anywhere. Well, the stock went sky high, but like all hyped things once the musical chair game came to an end the stock fell in a crash and burn manner.

Another example today is Google, which is a good search engine, but the business model is again not built upon hard assets. Investors buy up Google in what is called momentum investing just like they did Krispy Kreme, and it is only a matter of time before they get burned. I have a link for MSN stock within my links, and any stock may be looked up to see the ownership for institutional investors and financial data that includes book value.

As of the third quarter of 2005, several institutional investors made large investments in General Motors such as Deutsche Bank and Goldman Sachs. Now if General Motors were on the verge of bankruptcy, would it seem logical for institutional investors to scoop up the stock at low prices? The money makers do not like General Motors and Ford Motor Company in my opinion because they finance their products in the open market, and have the ability to set the interest rates charged and make money that they can keep. Can you see how this upsets the money power of the Federal Reserve System? If you know who controls the Federal Reserve, you should see why they would detest huge corporations such as General Motors and Ford. The power brokers that come on CNBC are repeatedly prodded with the leading question that suggests that GM should sell GMAC to help its finances. Now why in the world would GM want to get rid of its money making division of the corporation? If you watch CNBC consistently, as I have, you will see that there is one corporation that is not attacked by the journalist and that is General Electric. Why you may be asking? Well General Electric is the parent company of NBC.

What is so sad is that the American public is so gullible about whatever the news media feeds them, and there are people on a daily basis that say that they would never buy a Ford or a GM product, and proudly drive their foreign made vehicle. People do not realize that there are many Americans depending upon them to purchase these vehicles to keep Americans employed and the retirees depend upon vehicles to keep selling in order that their health insurance may be paid. Does it not seem sadistic for the media to want to see established American corporations forced out of business? My family will hold onto our stock because we still have faith in General Motors, and we pray that Americans wake up to the fact that you cannot turn your back on every American company and hope to have a solvent American economy.

Subscribe to:

Post Comments (Atom)

1 comment:

Well, it looks as though GM is shot to hell in a hand basket. As of today, October 10, 2009, Ford is trading at a litlle over $7.00 per share. For a good movie that depicts the state of Michigan and how the town has dried up with competition from foreign car manufacturers, I suggest the movie, "Gran Tornino." It is a movie by Clint Eastwood and starring Clint Eastwood. I actually drove a 1970 White Gran Torino that would not go in reverse most of the time, so I had to park heading out! LOL I suppose it had been wrecked, but I just had to have it. The movie, "Gran Torino" has a rather depressing ending, but Clint Eastwood is one of my favorite actors.

Post a Comment